British people suffering from gambling-related harm are much more susceptible to rising economic pressures in the country, a new report has claimed.

British people suffering from gambling-related harm are much more susceptible to rising economic pressures in the country, a new report has claimed.

At a time when the most recent fines imposed on local gambling operators by the UK Gambling Commission (UKGC), including the record-breaking penalty imposed on one of the largest companies in the sector, William Hill, the independent UK charity GamCare published a detailed analysis of the industry, revealing some concerning details about the nation.

Recently, the charity organisation unveiled a YouGov survey that outlines how Brits are sometimes forced to gamble in an effort to afford necessities in the light of rising inflation and price increase across the country. GamCare, which currently operates the National Gambling Helpline and shares regular updates on the progress of so-called customer protection measures in the local gambling industry, noted that problem gamblers were the ones suffering the most, with many of them entering a vicious circle that affects their entire lives.

Most Problem Gamblers in the UK Take Desperate Measures to Deal with Rising Cost of Living

GamCare revealed that over the past year, advisers on its National Gambling Helpline have heard multiple reports of how the increasing cost of living in the UK is affecting the lives of people who turn to the charity. The past 12 months have heard callers say they have been forced to take desperate measures in order to minimise their everyday spending on necessities, such as using betting outlets to warm themselves, people on Universal Credit turning to gambling in an attempt to make extra money to pay their bills, and people getting disability benefits turning to gambling hoping to make some extra money.

GamCare revealed that over the past year, advisers on its National Gambling Helpline have heard multiple reports of how the increasing cost of living in the UK is affecting the lives of people who turn to the charity. The past 12 months have heard callers say they have been forced to take desperate measures in order to minimise their everyday spending on necessities, such as using betting outlets to warm themselves, people on Universal Credit turning to gambling in an attempt to make extra money to pay their bills, and people getting disability benefits turning to gambling hoping to make some extra money.

The most recent analysis provided by GamCare examines the impact that the rising cost-of-living crisis in the UK has on people who deal with gambling-related harm. Unfortunately, the research findings are not optimistic at all.

The aforementioned survey was commissioned by the charity and carried out by YouGov among 4,202 adult Brits.

The data presented by GamCare claims that parents with gambling issues were the ones who felt the negative impact of the rising cost of living the most. About 50% of the ones who had gambled at dangerous levels said they had been forced to survive without some essentials, such as food or washing their clothes in order to afford something for their children over the past 12 months. In comparison, the percentage rate of UK parents overall is significantly smaller and stands at 20%.

Also, parents who had gambled excessively over the aforementioned period seem to be almost three times more likely to have been unable to purchase their children’s school uniforms than British parents overall, with more than four in ten of them (44%) confirming they had struggled to do so in comparison to one in seven (14%) of UK parents as a whole.

The organisation, which has been among the UK’s leading information, support and advice providers for people dealing with gambling addiction and suffering from gambling-related harm, claims that four in 10 gambling addicts in the country (42%) believed that taking part in gambling activities would help them improve their financial state in 2024 in comparison to only 7% of UK adults as a whole.

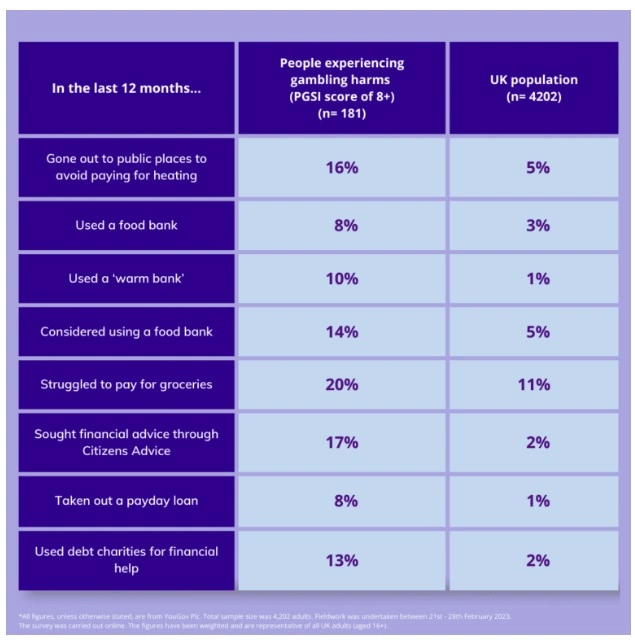

The research also found that one in six problem gamblers (16%) had visited public spaces to stay warm and avoid the need to pay for constantly rising energy costs, in comparison to only 5% of the country’s population.

Image credit: GamCare website

British Gambling Addicts More Likely to Continue Gambling in the Next 12 Months Than the Rest of UK Adult Population

According to data provided by GamCare, January 2023 was the month featuring the highest-ever number of calls to the National Gambling Helpline. At the time, callers continuously reported how the rising living costs had been affecting them.

According to data provided by GamCare, January 2023 was the month featuring the highest-ever number of calls to the National Gambling Helpline. At the time, callers continuously reported how the rising living costs had been affecting them.

As confirmed by the chief executive officer of the independent gambling charity organisation, Anna Hemmings, explained that the financial challenges associated with constantly rising cost-of-living were particularly acute for problem gamblers and people suffering from gambling-related harm. She explained that, unfortunately for gambling addicts, gambling was not an easy way to cope with financial problems and highlighted how important it was to address the financial issues by supporting the recovery from gambling harm of such individuals in the longer term.

As mentioned above, people struggling with their compulsive gambling behaviour scored substantially worse than the rest of the UK adults on a number of metrics during the survey. Many of the individuals who took part in the research admitted they truly relied on gambling to seek improvement of their financial state. Unfortunately, that only made their losses worse.

One of the most negative trends found by the survey showed that apart from already facing harm as a result of their decision to gamble in order to seek a short-term solution for their financial problems, British gambling addicts (42%) were much more likely to gamble more in the following 12 months as a result of the ongoing cost-of-living crisis in comparison to the rest of adult population in the UK (just 6%).

Such concerning reports once again highlight the ongoing difficulties with gambling that are being faced by the UK. The recent scandalous revelations regarding William Hill’s failure to comply with anti-money laundering and social responsibility regulations which resulted in the largest-ever monetary penalty imposed by the country’s gambling regulator only reiterated the fact that the competent authority was unable to actually prevent that from happening.

People Should Not Rely on Gambling to Ease Ongoing Financial Difficulties, GamCare Says

GamCare has warned British residents that gambling was not a reliable way to ease their financial difficulties because most gamblers tend to lose more than they win. The charity has also rolled out its new Money Guidance Service aimed at helping local gambling addicts get back on their feet by providing them with professional advice on their spending habits and suggestions on how to establish proper boundaries.

GamCare has warned British residents that gambling was not a reliable way to ease their financial difficulties because most gamblers tend to lose more than they win. The charity has also rolled out its new Money Guidance Service aimed at helping local gambling addicts get back on their feet by providing them with professional advice on their spending habits and suggestions on how to establish proper boundaries.

Data gathered as a result of the organisation’s latest survey also showed that problem gamblers are twice as likely to face some concerns about their job security (50%) in comparison to the rest of the adult population of the UK (26%). Furthermore, they were much more likely to confirm they had chased their losses (92%) compared to other British adults (25%), and were also almost twice more likely to use a prepayment metre than the general population, with the rates being 15% and 7%, respectively.

GamCare revealed that 79% of British problem gamblers who had placed bets or taken part in other forms of gambling in the past year had lost a significant amount of money while doing so, in comparison to only 5% of the country’s adults overall.

Gambling addicts in the country were eight times more likely to have drawn a payday loan in the last 12 months (8%) than the general public overall (only 1%), as well as six times more likely to have used debt charity organisations to get financial help over the last 12 months than the rest of UK adult population – 13% to 2%, respectively.

As mentioned above, the release of the YouGov survey’s findings coincided with the launch of the charity organisation’s new Money Guidance Service, which is set to work with people who have been suffering as a result of the negative financial impact that gambling had had on their lives and help them get back on their feet. Earlier in 2023, the scheme was originally unveiled in Leeds and the East Midlands region and is now available across the entire country to everyone calling the National Gambling Helpline.

Unfortunately, even though the charity has been making serious efforts to mitigate the negative effect of problem gambling in the country, gambling addiction rates in the UK continue to rise. According to the most recent data released by the UK Gambling Commission, gambling levels remained steady in the country in December 2022, there has been a significant increase in the number of people purchasing tickets of the National Lottery, including people exposed to moderate risk of gambling-related harm.

In a recent interview, Mike Kenward, the development director of GamCare, shared that the local public believes that gambling operators were not doing enough to tackle gambling-related harm and noted that the country’s gambling regulatory body needed to step up and take a more significant role in protecting Brits from the negative effects of the sector.

- Author